HRA – House Rent Allowance With Tax Exemption Rules

House rent allowance. More commonly known as HRA. If you had paid attention during the lesson on Income Tax in school, you might have had a better idea of what it is. But worry not, we’re here to help. In simple terms, house rent allowance is a component of salary that is paid to employees by an employer for their accommodation costs in the city, which also lets them get an HRA tax exemption on their income tax. House rent allowance is why you should pay more attention to your salary break-up when you get that offer letter from your company. And also why you should hold on to those house rent receipts.

Basis of HRA Calculation

House Rent Allowance is calculated based on the employee’s salary and the city they reside in. And a lot of it is up to the employer as well. But while this might make it sound complicated, the HRA calculation formula is pretty simple.

Basically, the tax exemption that one can claim on their House Rent Allowance is the lowest amount of these three:

- The rent paid by the employee minus 10% of their basic salary

- The total amount of House Rent Allowance offered by the employer

- 50% of the salary if the employee works in a Metro city or 40% if he or she works elsewhere

Not clear yet? Let’s use an example.

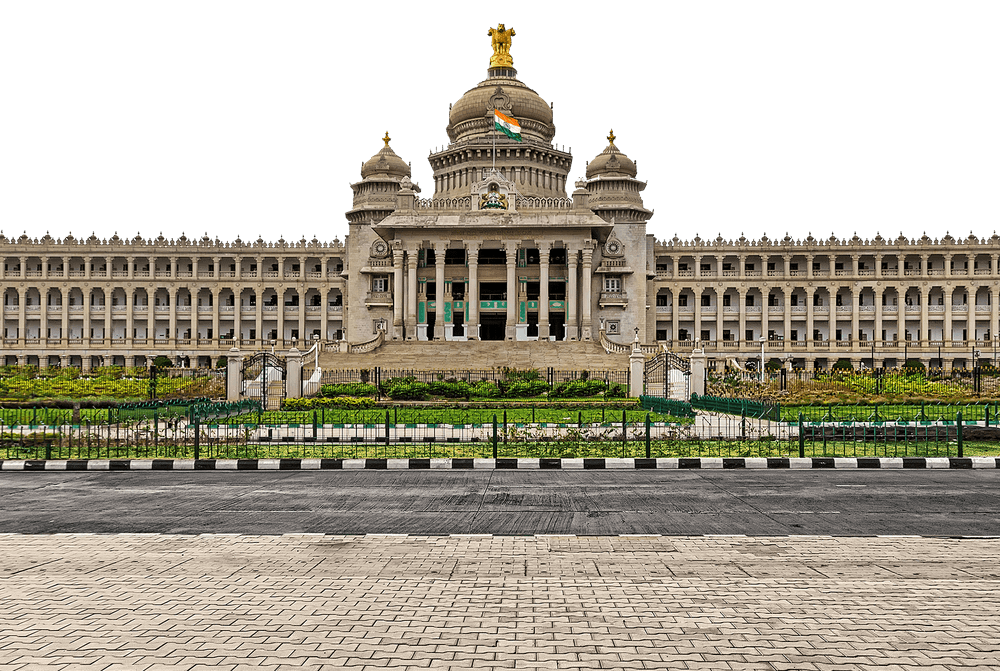

Say there’s a guy called Kirat Vohli, who works for a company called ‘Choyal Rallengers’ in Bangalore. The company gives him a salary of ₹1,00,000, which is broken up like this.

|

Kirat’s Salary Component |

Amount (₹) |

|

Basic |

Rs.50,000/- |

|

HRA |

Rs.20,000/- |

|

Conveyance |

Rs.8,000/- |

|

Medical Allowance |

Rs.12,000/- |

|

Special Allowance |

Rs.10,000/- |

|

Total Salary |

Rs.1,00,000/- |

Now, though Kirat Vohli’s HRA allowance is 20 grand, he pays a rent of only 18k. So which one of these will be his HRA tax exemption?

- Rent paid – 10% of basic salary = ₹18,000 – 10% of ₹50,000 = ₹13,000

- The HRA allowance offered by the company = ₹20,000

- 50% of basic salary (since he’s in a metro) = ₹25,000

Yup, the HRA tax exemption for Mr. Vohli will be ₹13,000. So, wasn’t that calculation as smooth as a cover drive by a cricketer whose name rhymes with Kirat Vohli?

What is HRA TAX Exemption?

HRA tax exemption is that amount that is deducted from an employee’s taxable income at the end of the year. It’s a cushion to the blow that is the skyrocketing rental rates in urban India. Now, you can do this only if you’re living in a rented apartment. People who have their own house cannot benefit from HRA calculation for income tax under Section 80GG. But then, half their salaries don’t go to their landlords as soon as it is credited to their bank accounts.

How is HRA TAX Calculated?

As we explained earlier, house rent allowance calculation is calculated on the basis of the HRA calculation formula, and the tax-exempt portion of the HRA is the minimum of the following elements:

- Actual HRA received from the employer

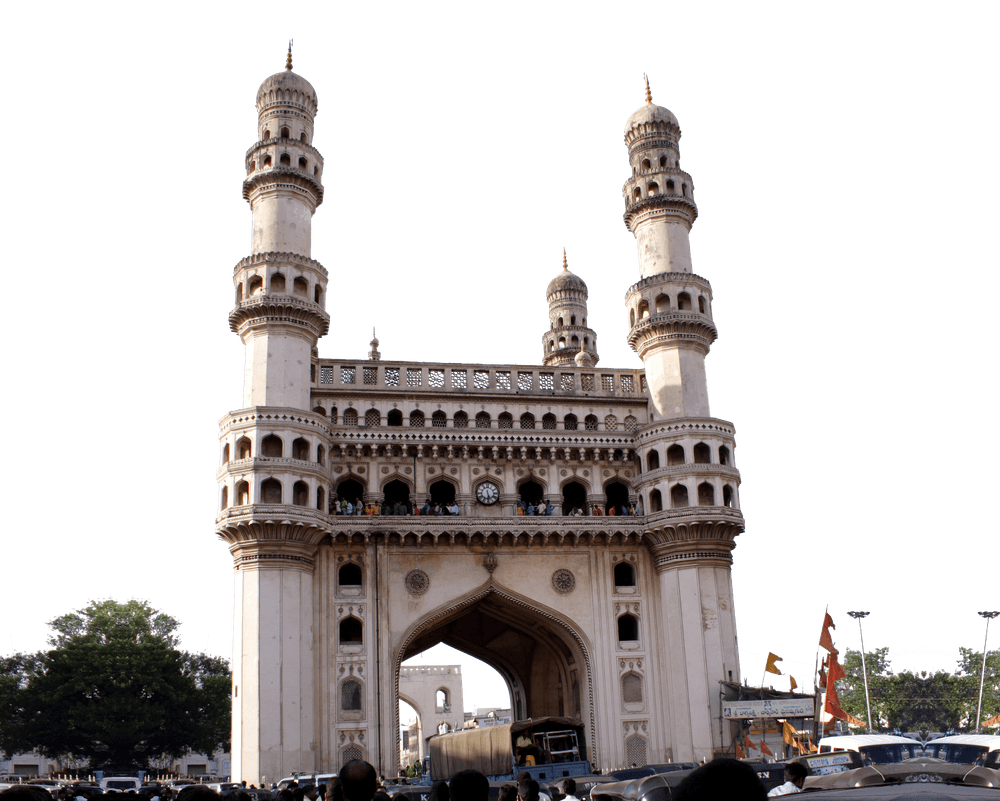

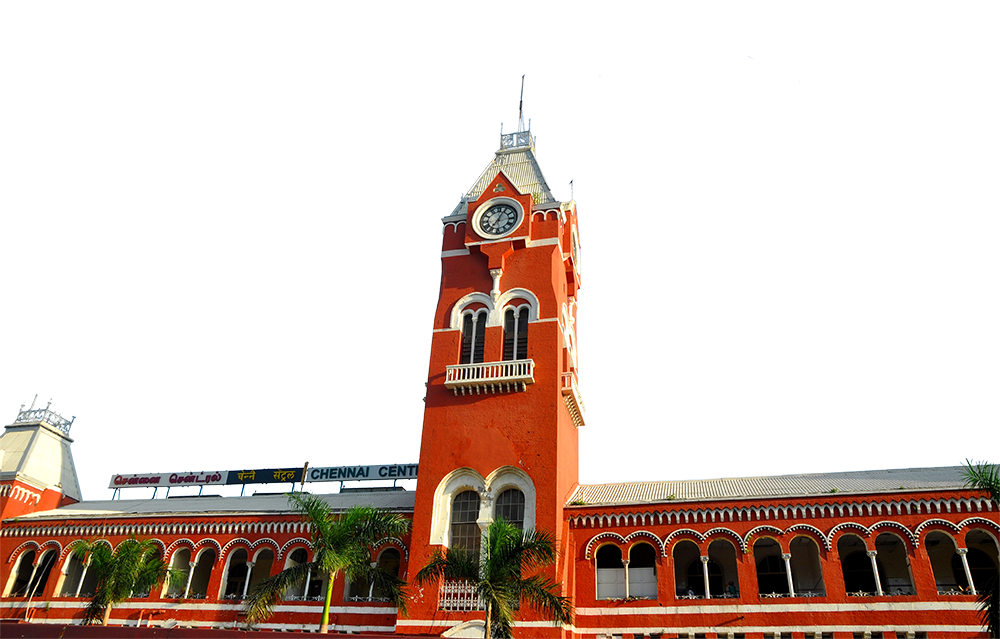

- 50% of the ‘salary’ if the accommodation is in the metro cities (Delhi, Mumbai, Chennai, Kolkata) and 40% for other cities

- Excess rent paid annually over 10 per cent of the annual ‘salary’

Note here that ‘salary’ means basic salary, dearness allowance (DA) and commission received on the basis of percentage of turnover. So don’t get ahead of yourself and make the HRA calculation based on your entire CTC.

Rules to Claim HRA

Some of the most important HRA claim rules are as follows:

- In order to avail of HRA benefits, it is not necessary that you pay rent only to a landlord. You can even pay rent to parents or family members and show house rent receipts to claim HRA exemption

- Claiming HRA is not possible if you’re paying rent to your spouse. Sorry, married folks

- All relevant receipts of rent paid need to be submitted as proof. So don’t ignore them like your boss ignores all the hard work you do

- PAN card details of the landlord also need to be submitted so that relevant tax deductions can be made from the rent they received, but only if the rent paid exceeds 1 lakh pa

- If you’re living in your own house and receive House Rent Allowance, do keep in mind that the amount is not exempt from income tax (maybe talk to HR about adjusting your salary components?)

FAQs on House Rent Allowance

Can I Claim both HRA and Home Loan Interest for TAX deduction?

Good news. You can claim income tax exemption on both HRA and home loans. If you are living in a rented place and paying a home loan on some other property, you can claim tax benefits for both of them. Even if they are located in the same city.

What percentage of TAX is Deducted on HRA?

So the least of these three amounts is your tax exemption on HRA

The remaining amount is taxed as per the tax slab you’re in.

Can I Claim HRA if I am Living in my own House?

Yes, you can but for that, you need to show proof of the required documents for HRA deduction. For example, if your parents are the owners and you pay house rent to them, you can claim the tax benefit if you can provide the house rent receipts.

How to Claim Benefits of Home Loan through HRA?

You can claim HRA exemption on home loan interest under section 24 and principal repayment under section 80C, when you pay rent in one city and own a house in another.

Is a PG in Bangalore right for you? A quick guide to PG rentals

Read more

Stanza Living PG vs Local PG in Bangalore: Facilities, Pricing and Experience

Read more

PG vs Renting a Flat in Bangalore: Cost, Convenience and Lifestyle Comparison

Read more

How to Choose the Best PG in Bangalore: Step-by-Step Guide

Read more

Benefits of Staying in a PG in Bangalore: Flexibility, Amenities and Community

Read more

Choosing the Right PG in Bangalore: Key Factors

Read more

- PGs in Bengaluru

- PGs in BTM Layout

- PGs in Banashankri

- PGs in Bellandur

- PGs in Domlur

- PGs in Electronic City Phase 1

- PGs in Electronic City Phase 2

- PGs in HSR Layout

- PGs in Hesaraghatta Road

- PGs in Kadubeesanahalli

- PGs in Kanakpura Road

- PGs in Kengeri

- PGs in Koramangala

- PGs in Kristu Jayanti

- PGs in Kumaraswamy Layout

- PGs in Kundalahalli Gate

- PGs in Magadi Road

- PGs in Mahadevapura

- PGs in Manyata Tech Park

- PGs in Marathahalli

- PGs in Mathikere

- PGs in RVCE

- PGs in Rajankunte

- PGs in Rajarajeshwari Nagar

- PGs in Reva University

- PGs in Sarjapur Road

- PGs in Soladevanahalli

- PGs in Whitefield

- Flats in Bengaluru

- Flats in BTM Layout

- Flats in Bellandur

- Flats in Bhartiya City

- Flats in Electronic City Phase 1

- Flats in Electronic City Phase 2

- Flats in HSR Layout

- Flats in Indiranagar

- Flats in JP Nagar

- Flats in Koramangala

- Flats in Kumaraswamy Layout

- Flats in Manyata Tech Park

- Flats in Marathahalli

- Flats in Sarjapur Road

- Flats in Whitefield

- Sonoma House, Koramangala

- Norwich House, Marathahalli

- Shanghai House, Bellandur

- Lincoln House, Electronic City Phase 1

- Vernon House, Reva University

- Durham House, Whitefield

- Turin House, Electronic City Phase 1

- Seattle House, Bellandur

- Ibarra House, Reva University

- Lisbon House, Electronic City Phase 1

- Sofia House, Sarjapur Road

- Rimini House, Bellandur

- Heidelberg House, Kundalahalli Gate

- Incheon House, Reva University

- Frankfurt House, Koramangala

- Newport House, Reva University

- Sao Paulo House, Whitefield

- Brussels House, Bellandur

- Springbok House, Kundalahalli Gate

- Amsterdam House, Electronic City Phase 1

- Bochum House, Bellandur

- St Petersburg House, Manyata Tech Park

- Medan House, Whitefield

- Salta House, Reva University

- Nairobi House, Manyata Tech Park

- Salento House, Reva University

- Hamburg House, Koramangala

- Ronda House, Reva University

- Manchester House, Manyata Tech Park

- Salzburg House, Koramangala

- Cologne House, Mathikere

- Bratislava House, Koramangala

- Como House, Koramangala

- Shrewsbury House, Koramangala

- Vaduz House, Koramangala

- Dortmund House, Mathikere

- Fargo House, Mathikere

- Aswan House, Mathikere

- Rostock House, Mathikere

- Granada House, RVCE

- Cordoba House, RVCE

- Spielberg House, Koramangala

- Laredo House, Mathikere

- Vilnius House, Mathikere

- Kiev House, Kumaraswamy Layout

- Bilbao House, HSR Layout

- Scottsdale House, Marathahalli

- Modesto House, HSR Layout

- Teresina House, Koramangala

- Podolsk House, Koramangala

- Narbonne House, Koramangala

- Villareal House, Koramangala

- Jerez House, Koramangala

- Chatham House, Marathahalli

- Leeds House, Koramangala

- Lafayette House, Koramangala

- Lusaka House, Koramangala

- Albury House, Rajankunte

- Anamur House, Kumaraswamy Layout

- Lobito House, Mathikere

- Wichita House, Magadi Road

- Crotone House, Rajarajeshwari Nagar

- Cuneo House, Rajarajeshwari Nagar

- Casper House, Domlur

- Tamale House, Hesaraghatta Road

- Cayenne House, Mahadevapura

- Saratov House, Rajarajeshwari Nagar

- Batumi House, Rajarajeshwari Nagar

- Wakefield House, Kadubeesanahalli

- Padova House, Magadi Road

- Evora House, Hesaraghatta Road

- Jounieh House, BTM Layout

- Nome House, Rajarajeshwari Nagar

- Volos House, Kengeri

- Cicero House, Electronic City Phase 2

- Tumaco House, Kumaraswamy Layout

- Calabar House, Kumaraswamy Layout

- Monza House, Whitefield

- Huelva House, RVCE

- Managua House, Soladevanahalli

- Tacoma House, Soladevanahalli

- Serov House, Rajankunte

- Langley House, Kadubeesanahalli

- Bakersfield House, Whitefield

- Viseu House, Mathikere

- Dublin House, Electronic City Phase 2

- Davao House, Soladevanahalli

- Debrecan House, Rajarajeshwari Nagar

- Solingen House, Kanakpura Road

- Maturin House, Magadi Road

- Rotherham House, Kumaraswamy Layout

- Krefeld House, Magadi Road

- Luhansk House, Kengeri

- Modena House, Manyata Tech Park

- Bismarck House, Soladevanahalli

- Glencoe House, Rajankunte

- Salisbury House, Kristu Jayanti

- Cork House, HSR Layout

- Watford House, Rajankunte

- Nottingham House, Mahadevapura

- Varda House, Hesaraghatta Road

- Kampala House, Banashankri

- PGs in Mumbai

- PGs in Andheri East

- PGs in Bandra

- PGs in Juhu

- PGs in Kharghar

- PGs in Vile Parle

- Flats in Mumbai

- Flats in Andheri East

- Flats in Vile Parle

- New Orleans House, Vile Parle

- Benin House, Bandra

- Norman House, Andheri East

- Monterrey House, Juhu

- Cincinnati House, Kharghar

- PGs in Gurgaon

- PGs in Golf Course Extension

- PGs in HUDA City Center

- PGs in Medanta

- PGs in Sohna Road

- Flats in Gurgaon

- Flats in DLF Phase 4

- Flats in Golf Course Extension

- Flats in Golf Course Road

- Flats in HUDA City Center

- Flats in Medanta

- Flats in Sohna Road

- Dunkirk House, Sohna Road

- Tortosa House, Golf Course Extension

- Pisa House, HUDA City Center

- Taiping House, Medanta

- Crawley House, Medanta

- PGs in Pune

- PGs in Akurdi

- PGs in Balewadi

- PGs in Baner

- PGs in Dhankawadi

- PGs in Hinjawadi

- PGs in Karve Nagar

- PGs in Kharadi

- PGs in Kondhwa

- PGs in Kothrud

- PGs in Lohegaon Dhanori

- PGs in Loni Kalbhor

- PGs in Narhe

- PGs in Senapati Bapat Road

- PGs in Shivaji Nagar

- PGs in Vadgaon

- PGs in Viman Nagar

- PGs in Wagholi

- PGs in Wakad

- Flats in Pune

- Flats in Balewadi

- Flats in Baner

- Flats in Hadapsar

- Flats in Hinjawadi

- Flats in Kharadi

- Flats in Koregaon Park

- Flats in Pimple Saudagar

- Flats in Senapati Bapat Road

- Flats in Wakad

- Whitehaven House, Wagholi

- Austin House, Kondhwa

- Malmo House, Viman Nagar

- Pelotas House, Vadgaon

- Haifa House, Baner

- Sarnen House, Dhankawadi

- Tripoli House, Loni Kalbhor

- Florence House, Hinjawadi

- Karlsruhe House, Wakad

- Kingston House, Wagholi

- Tel Aviv House, Baner

- Shiraz House, Dhankawadi

- Parma House, Hinjawadi

- Barnsley House, Lohegaon Dhanori

- Giza House, Dhankawadi

- Positano House, Hinjawadi

- Ripon House, Wagholi

- Girona House, Dhankawadi

- Reno House, Hinjawadi

- Manisa House, Wagholi

- Napier House, Akurdi

- Cairo House, Dhankawadi

- Alexandria House, Dhankawadi

- Pinsk House, Vadgaon

- Sidon House, Vadgaon

- Oran House, Karve Nagar

- Dover House, Wakad

- Livermore House, Viman Nagar

- Tartus House, Vadgaon

- Evansville House, Viman Nagar

- Herat House, Lohegaon Dhanori

- Upington House, Karve Nagar

- Mckinney House, Karve Nagar

- Boulder House, Shivaji Nagar

- Andria House, Senapati Bapat Road

- Waco House, Balewadi

- Presov House, Viman Nagar

- Marseille House, Hinjawadi

- Syzran House, Kondhwa

- Cosenza House, Shivaji Nagar

- Sarasota House, Shivaji Nagar

- Mogilev House, Narhe

- Mansa House, Karve Nagar

- Kenitra House, Dhankawadi

- Alanya House, Kharadi

- Schengen House, Wakad

- Semey House, Wakad

- Tallinn House, Hinjawadi

- Bissau House, Loni Kalbhor

- Juliaca House, Kondhwa

- Tobruk House, Karve Nagar

- Amiens House, Kharadi

- Pereira House, Wakad

- Reynosa House, Hinjawadi

- Telford House, Loni Kalbhor

- Torreon House, Wagholi

- Nelson House, Akurdi

- Akron House, Kothrud

- PGs in Ahmedabad

- PGs in Bopal & Shilaj

- PGs in Gota

- PGs in Navrangpura

- PGs in Vastrapur & Thaltej

- Wilmington House, Navrangpura

- Portland House, Gota

- Annapolis House, Navrangpura

- Odessa House, Gota

- Evanston House, Vastrapur & Thaltej

- Elgin House, Bopal & Shilaj

- Callao House, Navrangpura

- PGs in Hyderabad

- PGs in Ameerpet

- PGs in Aziznagar

- PGs in Gachibowli

- PGs in Gandi Maisamma

- PGs in Himayatnagar

- PGs in Kondapur

- PGs in Kukatpally

- PGs in Madhapur

- PGs in Narsingi

- PGs in Q City

- Flats in Hyderabad

- Flats in Gachibowli

- Flats in Hitec City

- Flats in Kondapur

- Flats in Q City

- Bagan House, Kukatpally

- Maribor House, Kondapur

- Burnley House, Kondapur

- Amarillo House, Q City

- Vernier House, Narsingi

- Lagos House, Gandi Maisamma

- Syracuse House, Gandi Maisamma

- Mendoza House, Gachibowli

- Canberra House, Kukatpally

- Brasov House, Aziznagar

- Munich House, Gachibowli

- Tuzla House, Gandi Maisamma

- Belgrade House, Ameerpet

- Queenstown House, Aziznagar

- Cartagena House, Himayatnagar

- Rochdale House, Narsingi

- Bolton House, Narsingi

- Lublin House, Gandi Maisamma

- Dijon House, Narsingi

- Conroe House, Gachibowli

- Kassel House, Gachibowli

- Launceston House, Aziznagar

- Vigo House, Gachibowli

- Winnipeg House, Madhapur

- Bremen House, Gachibowli

- Zenica House, Gandi Maisamma

- Marianna House, Gachibowli

- Sunderland House, Gachibowli

- Memphis House, Q City

- Sandakan House, Aziznagar

- Rabat House, Gachibowli

- Limoges House, Gachibowli

- Meknes House, Gandi Maisamma

- Merlo House, Aziznagar

- Gateshead House, Gandi Maisamma

- Troyes House, Narsingi

- PGs in Delhi

- PGs in Laxmi Nagar

- PGs in North Campus

- PGs in South Campus

- Cardiff House, Laxmi Nagar

- Sendai House, South Campus

- Boston House, North Campus

- Quito House, Laxmi Nagar

- Nagoya House, South Campus

- Montreal House, North Campus

- Poznan House, Laxmi Nagar

- Perugia House, Laxmi Nagar

- Kiel House, North Campus

- Kobe House, South Campus

- Sheffield House, North Campus

- Penzance House, North Campus

- Hiroshima House, South Campus

- Toronto House, North Campus

- Romford House, North Campus

- Stockton House, North Campus

- San Diego House, North Campus

- Kawasaki House, South Campus

- Weymouth House, North Campus

- Okazaki House, South Campus

- Derby House, North Campus

- Ventura House, North Campus

- Armagh House, North Campus

- Nuremberg House, North Campus

- Bukhara House, North Campus

- Ancona House, Laxmi Nagar

- PGs in Chennai

- PGs in Anna Nagar

- PGs in Guindy

- PGs in Nungambakkam

- PGs in OMR

- PGs in Pallavaram

- PGs in Poonamallee

- PGs in Porur

- PGs in Urapakkam

- PGs in Vadapalani

- Flats in Chennai

- Flats in Anna Nagar

- Flats in Guindy

- Flats in OMR

- Flats in Porur

- Eugene House, Poonamallee

- Doncaster House, Pallavaram

- Odense House, Nungambakkam

- Agadir House, Porur

- Luton House, Porur

- Getafe House, OMR

- Clarksville House, Nungambakkam

- Flensburg House, Nungambakkam

- Conway House, OMR

- Osasco House, Nungambakkam

- Vitoria House, OMR

- Toledo House, Nungambakkam

- Tulsa House, Nungambakkam

- Greensboro House, OMR

- Santa Rosa House, OMR

- Mataro House, OMR

- Tyler House, OMR

- Sarnia House, Porur

- Harrogate House, Urapakkam

- Shumen House, Guindy

- Essen House, Porur

- Murcia House, Anna Nagar

- Erbil House, Urapakkam

- Irving House, Porur

- Mildura House, Vadapalani

- Naperville House, Pallavaram

- Springfield House, Pallavaram

- Latina House, Porur

- Zwickau House, Urapakkam

- Fernley House, Urapakkam

- Mazatlan House, Pallavaram

- Warrington House, Pallavaram

- Knoxville House, Pallavaram

- Grodno House, Guindy

- PGs in Coimbatore

- PGs in Avinashi Road

- PGs in Gandhipuram

- PGs in Saravanampatti

- Adana House, Avinashi Road

- Cali House, Avinashi Road

- Brunswick House, Avinashi Road

- Calgary House, Avinashi Road

- Rivas House, Gandhipuram

- Salto House, Avinashi Road

- Metz House, Saravanampatti

- Smolensk House, Avinashi Road

- Waterloo House, Avinashi Road

- Carmen House, Avinashi Road

- Savannah House, Avinashi Road

- Burbank House, Saravanampatti

- Quimper House, Saravanampatti

- PGs in Greater Noida

- PGs in Knowledge Park

- Rijeka House, Knowledge Park

- Chicago House, Knowledge Park

- Adelaide House, Knowledge Park

- Athens House, Knowledge Park

- Paris House, Knowledge Park

- PGs in Vadodara

- PGs in Ajwa Road

- PGs in Fatehgunj

- PGs in Sayaji Bagh

- PGs in Waghodia Road

- Christchurch House, Waghodia Road

- Drammen House, Fatehgunj

- Auckland House, Waghodia Road

- Oslo House, Sayaji Bagh

- Wellington House, Ajwa Road

- Hamilton House, Ajwa Road

- PGs in Dehradun

- PGs in Pondha

- Kotor House, Pondha

- Semarang House, Pondha

- Jinan House, Pondha

- Luzon House, Pondha

- Koh Samui House, Pondha

- Yangon House, Pondha

- Pattaya House, Pondha

- Manila House, Pondha

- Marsala House, Pondha

- Zaragoza House, Pondha

- Rennes House, Pondha

- PGs in Indore

- PGs in Bhanwar Kua

- PGs in Geeta Bhawan

- PGs in Rau

- PGs in Vijay Nagar

- Tunis House, Rau

- Riga House, Bhanwar Kua

- Lucerne House, Vijay Nagar

- Verona House, Rau

- Boden House, Bhanwar Kua

- Elista House, Bhanwar Kua

- Pasadena House, Vijay Nagar

- Segovia House, Vijay Nagar

- Kolding House, Geeta Bhawan

- Rotorua House, Rau

- Easton House, Vijay Nagar

- Beira House, Geeta Bhawan

- Prato House, Rau

- Pretoria House, Bhanwar Kua

- Santa Barbara House, Bhanwar Kua

- Cameron House, Vijay Nagar

- Durban House, Geeta Bhawan

- Nazareth House, Geeta Bhawan

- Trafford House, Vijay Nagar

- Nimbus House, Vijay Nagar

- Caen House, Vijay Nagar

- Valera House, Vijay Nagar

- Culiacan House, Bhanwar Kua

- Minya House, Vijay Nagar